Good afternoon to all Blue Check U Students, Staff, readers, donors, stakeholders, and anyone else who happens to stumble upon this post! This is BCU’s President, formerly “Commish”, with a SPECIAL post to commemorate the events and happenings take took place this past week.

For those who may have missed the news, there’s a LOT going on in the world right now; especially pertaining to the Stock Market, Wall Street, Reddit, and the ever-popular brokerage app “Robinhood”. To spare you lengthy details and boring articles, we will use tweets from our Blue Checkmark friends to guide the way, per usual. The crux of the story, however, is that we have found ourselves in a position where, through Reddit coordination, the ‘common man’ has caused billionaires to lose BILLIONS of dollars in the stock market. Let’s begin, shall we?

Humble Beginnings

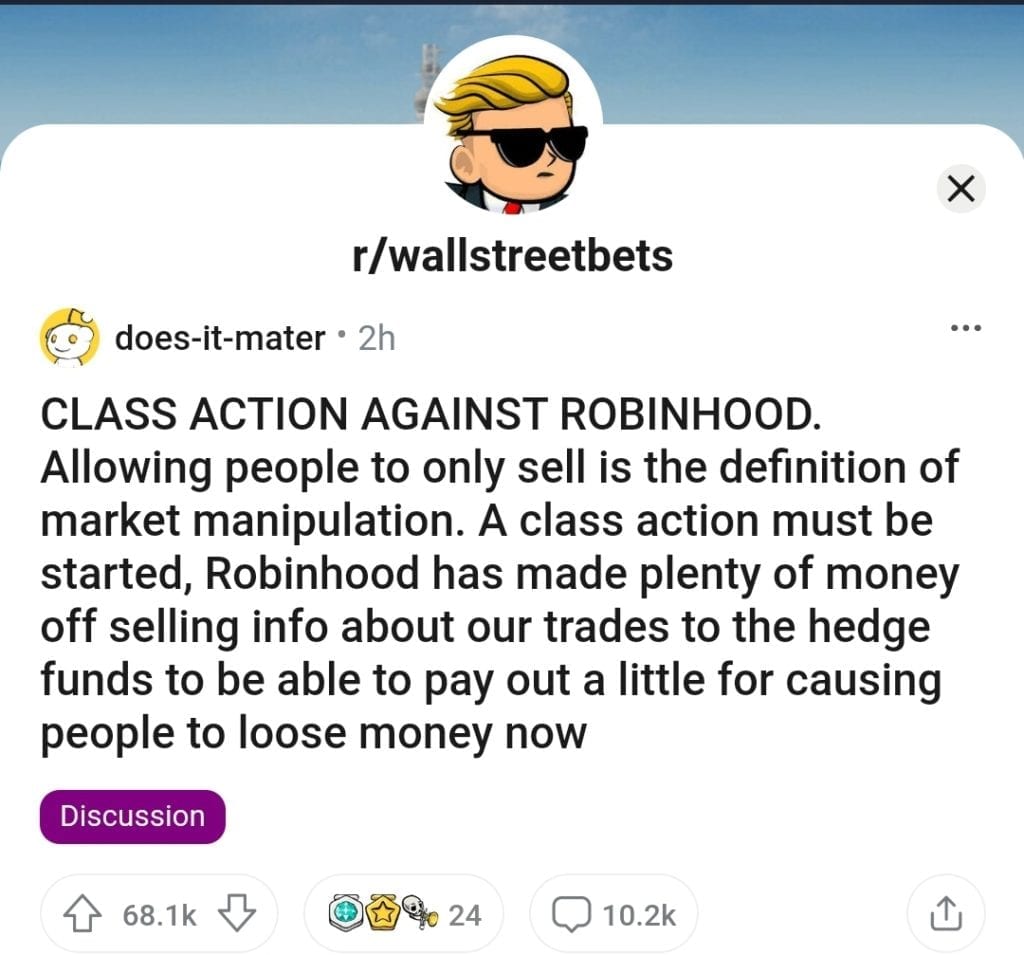

It all starts with r/wallstreetbets, a popular subreddit where users discuss varying stock market trades, activities, etc. While we weren’t personally a part of the community, word of their ‘plans’ had been spreading throughout the internet. Dying companies like Gamestop, Nokia, Express, Naked, and others, were to be bought en masse by the community through the Robinhood app. Their goal? Cause investors of hedge funds and other wealthy entities to “short sell” their holdings in said companies. This way, hedge funds could profit off of the sudden rise while simultaneously hoping for a price dip in the near future.

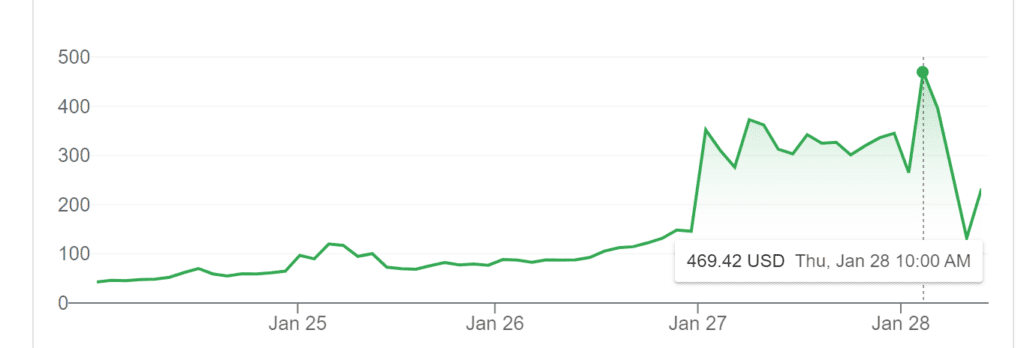

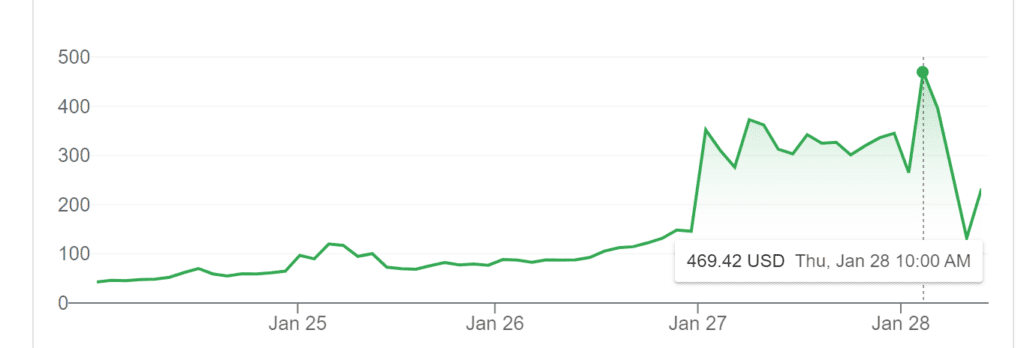

The problem for the billionaires arises when they are up against ‘numbers’. Because of the coordination of r/wallstreetbets and the large volume of trading associated with the aforementioned companies, billionaire “short sellers” were actually pumping up the price and playing right into the hands of the community. The chart below illustrates how sudden the fluctuation in prices were for Gamestop:

Mind you, Gamestop was a company that was struggling to hit $20/share as recently as January 12th. On top of the struggling stock (and coinciding with their poor stock performance) was the fact that their business model became outdated and obsolete. There really was no reason to seriously invest in the company outside of coordinated efforts. That’s what made billionaires and hedge funds especially eager to dump their stocks……but at what cost?

$5.05 BILLION dollars lost by billionaires. You may be thinking to yourself, “How do you know it was just billionaires losing money?”. With that in mind, you have to remember how poorly Gamestop was doing as a company and consider the “common man”. Nobody was investing in Gamestop in large amounts unless they had a sizable disposable income. The only other group that held a large amount of shares (beyond billionaire hedge funds) was the aforementioned r/wallstreetbets, who were of course doing this in a coordinated manner. They certainly weren’t selling their shares, knowing that the “short sells” would only help their efforts.

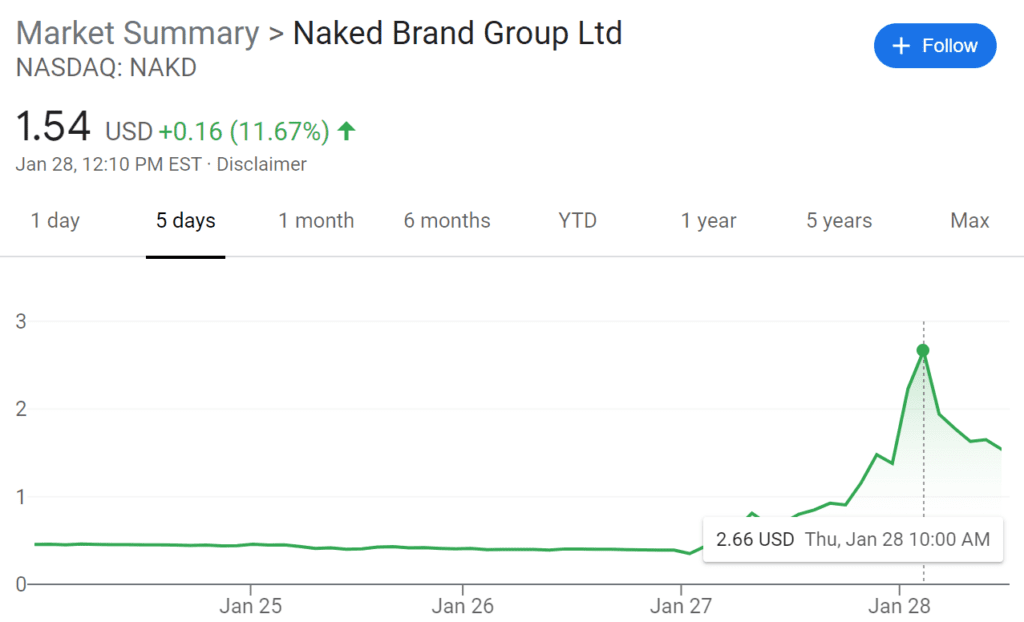

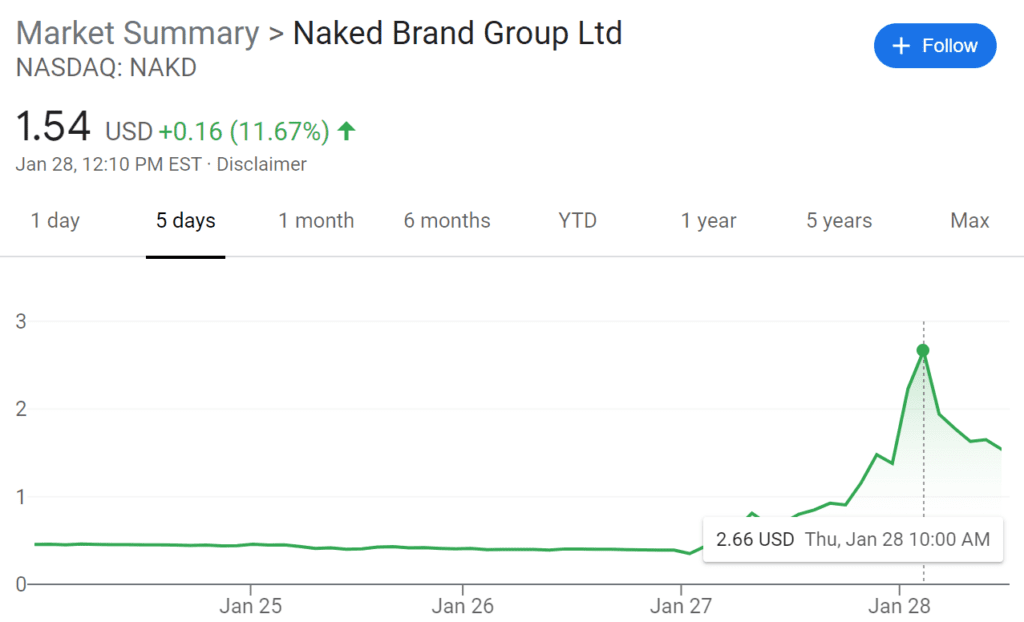

Point being, billionaires lost a LOT of money with Gamestop, thanks to the coordinated efforts of one subreddit. But it didn’t stop there. Take a gander a some of these other “meme stocks” that saw price fluctuations and “short selling” en masse (look where the dot is on the chart and check right below to see the peak price):

Companies that have surely seen better days were now the “biggest gainers” in Wall Street. With all due respect to Nokia and AMC, surely there wasn’t actual growth potential in their stock, right?

Things were getting so intense that accusations of a Reddit ‘Ponzi Scheme’ were being tossed around by MSM outlets; who of course act as corporate mouthpieces for their billionaire owners. We will get to the reactions shortly……but talk about a quality piece of satire by CNET.

The Seeds of ‘Unity’ Are Planted

Our explanation of the situation was VERY baseline and undetailed. We are not financial experts and are not in a position to explain the nuances of what specifically happened. Hopefully that provided somewhat of a background for those who were unaware.

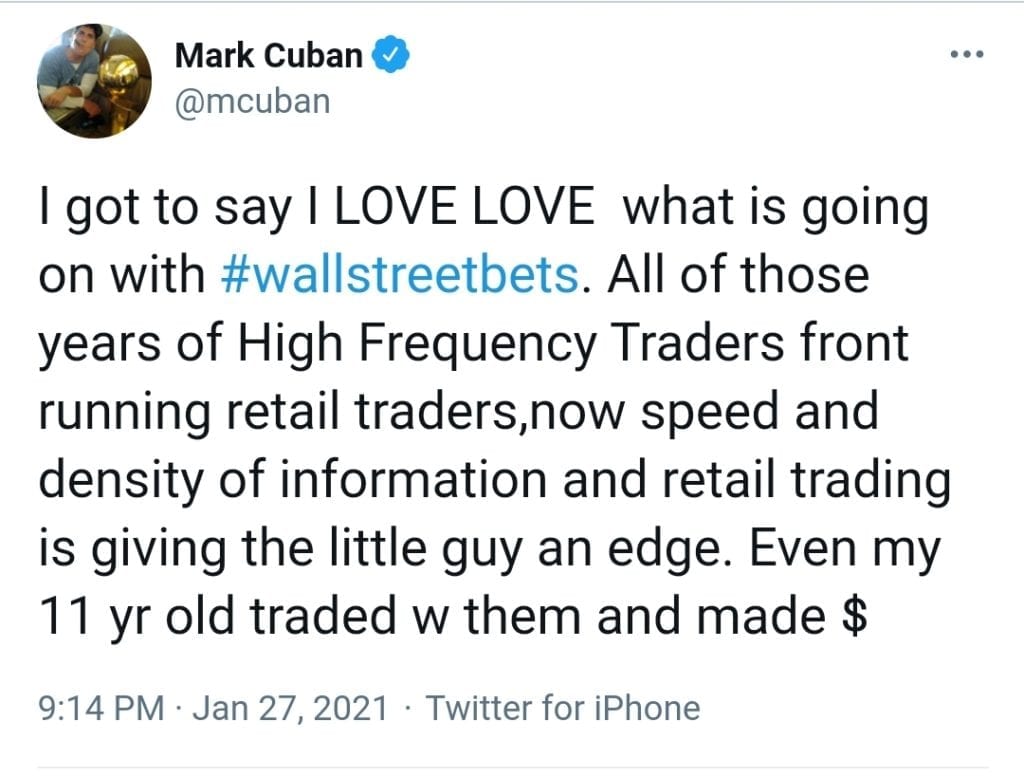

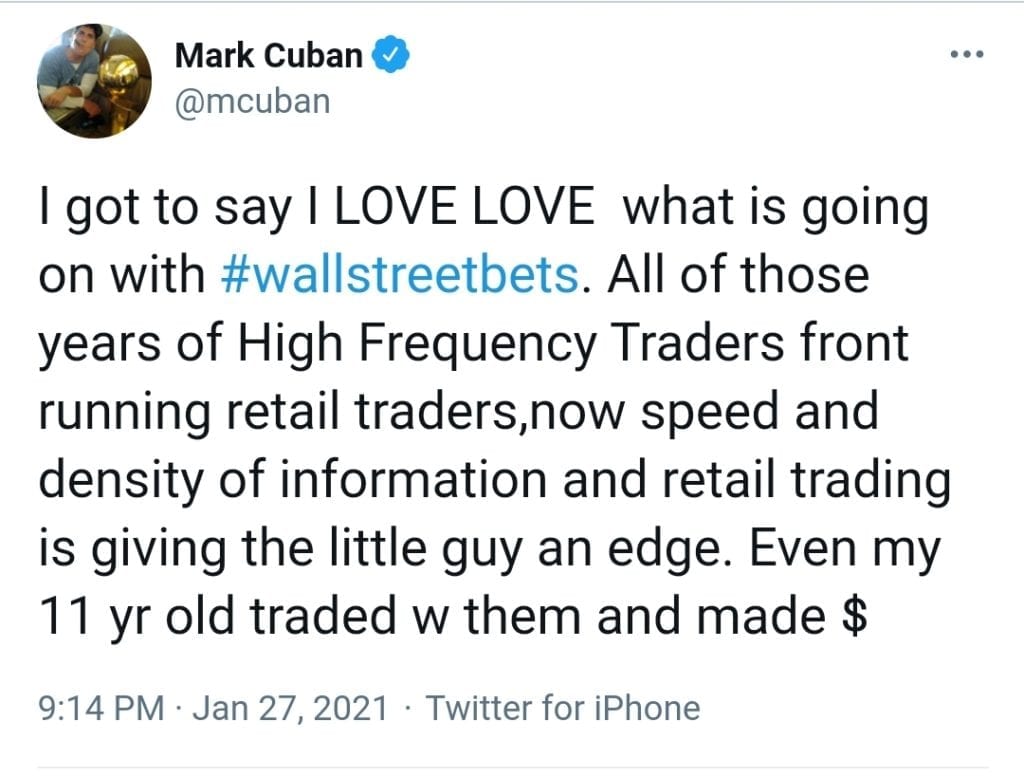

NOW it’s time for our specialty: the reactions from Blue Checkmark Twitter users. Admittedly, there are a LOT of Blue Checkmarks with quality takes and hilarious commentary on the situation at hand. There were also Blue Checkmark takes that only reinforced the creation of this site. A mixed bag of sorts. Interestingly enough, the thought of billionaires losing tons of money was something that unified both the “left” and “right”. While we don’t prescribe to sophomoric labels to describe generalized opinions on a complexity of issues, you couldn’t help but be encouraged by the unity displayed by both sides.

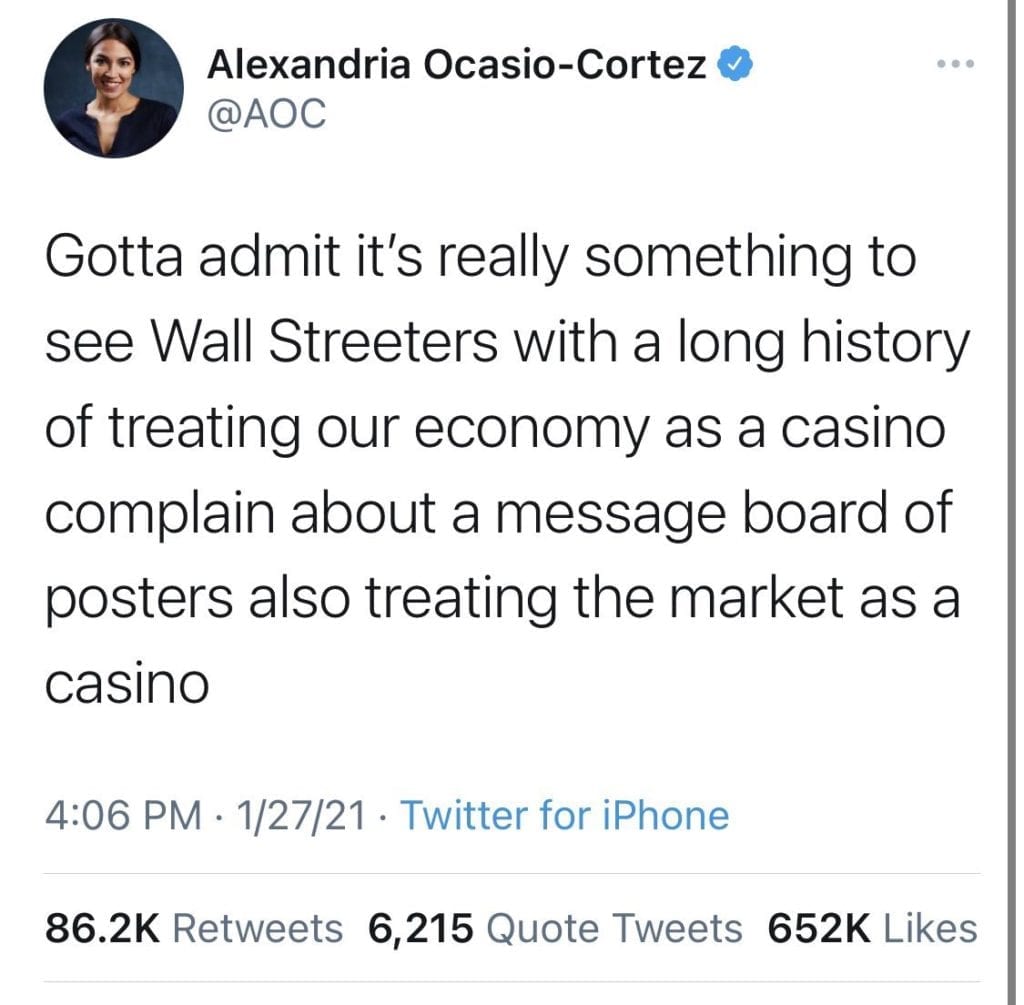

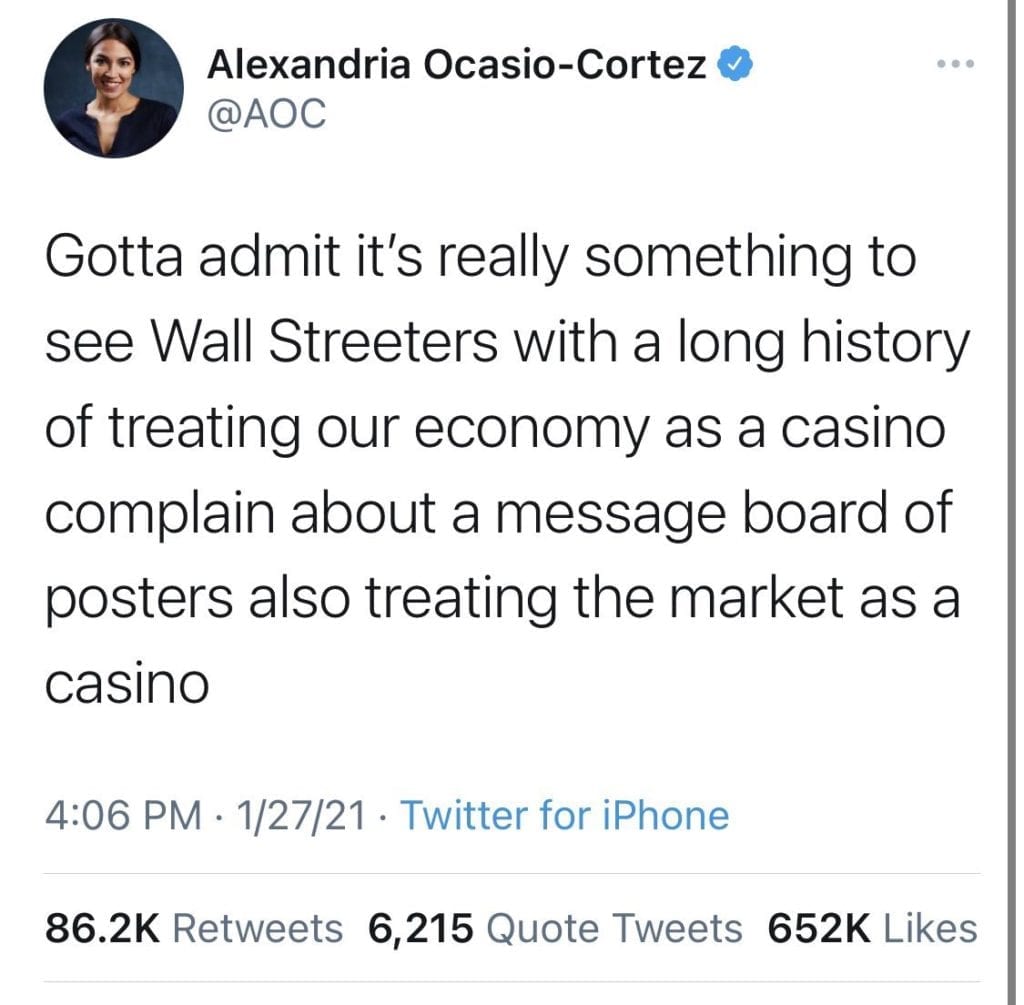

Perhaps my favorite example of this ‘unity’ came from two of the more polarizing figures in our dichotomized party system:

Donald Trump Jr. and Alexandria Ocasio-Cortez actually agreed on the fact that it was awesome to watch billionaires lose money. Now we won’t get ahead of ourselves, as Don Jr. will continue to try and “own the libs” and shill for Israeli interest, while AOC will make everything about race. This does show that, through EVERYTHING the US has gone through politically, there IS indeed common ground on a pretty sizable issue. If only for a couple of days, “right vs left” took a backseat to watching billionaires cry via Twitter and MSM outlets. This will be a common theme throughout the rest of the post.

The Fallout Begins

When you think about the story and everything that went down, almost EVERYONE should be on the side of the Redditors, right? Suffice to say, MSM companies and their billionaire-mouthpiece journalists were NONE TOO PLEASED with the ‘common man’ making money at their handlers’ expense. While this is to be expected from the ‘libertarian’ types or ‘faux conservatives’, some generally ‘left leaning’ outlets were in the same boat and shilling for billionaires. Not to say that everyone supporting the billionaires is ‘compromised’, but the context certainly lends itself to quite a few questions about their ‘interests’.

CNN’s SECOND WORST personality (behind Brian Stelter) mustered up a big brain take that somehow placed the blame on Orange Man.

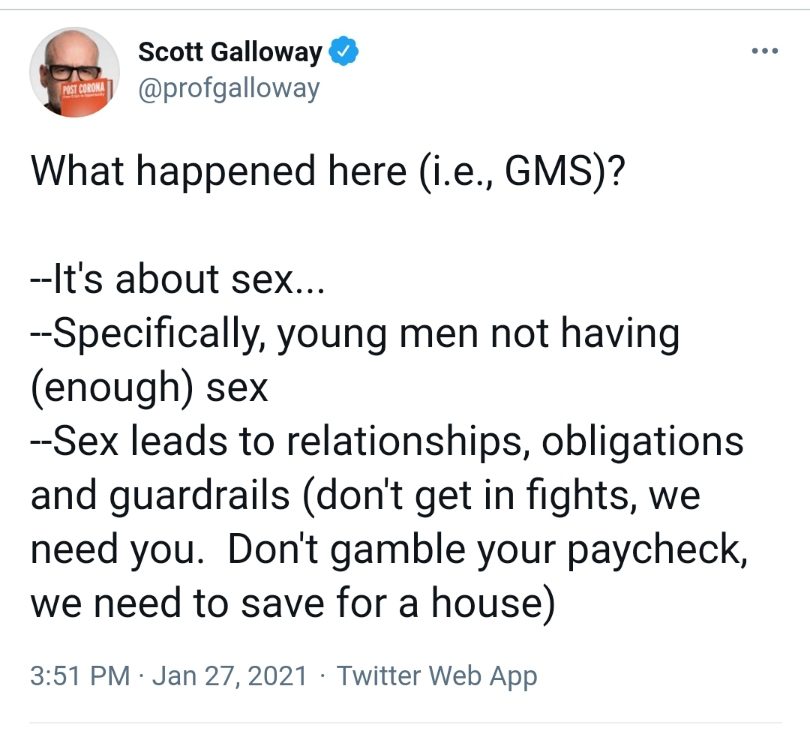

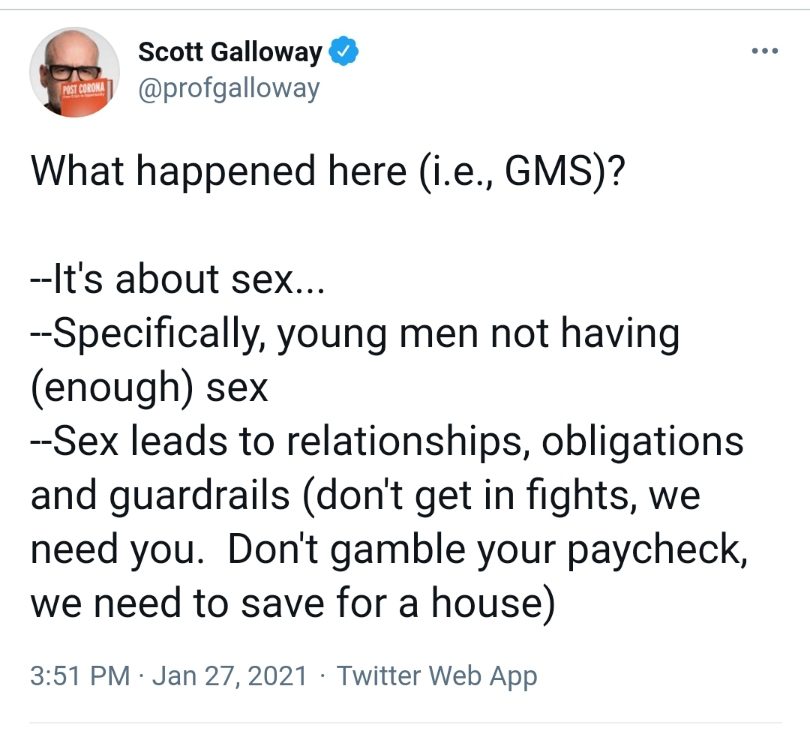

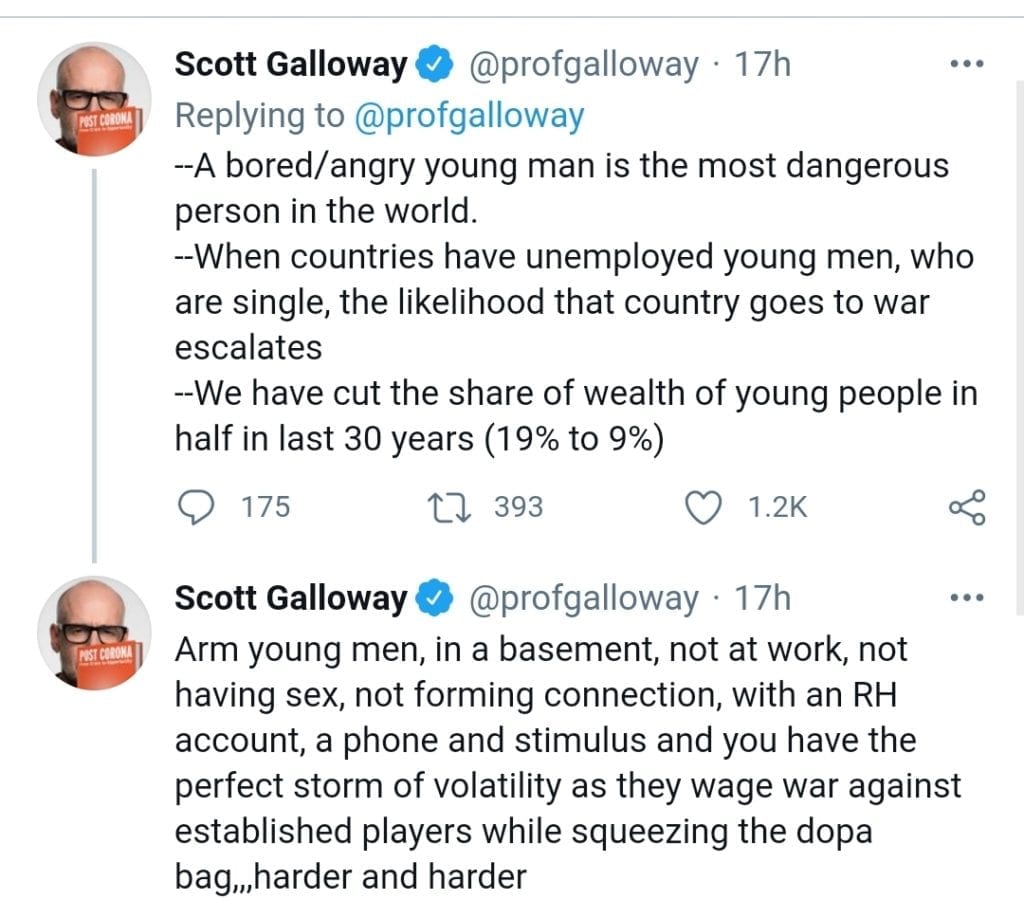

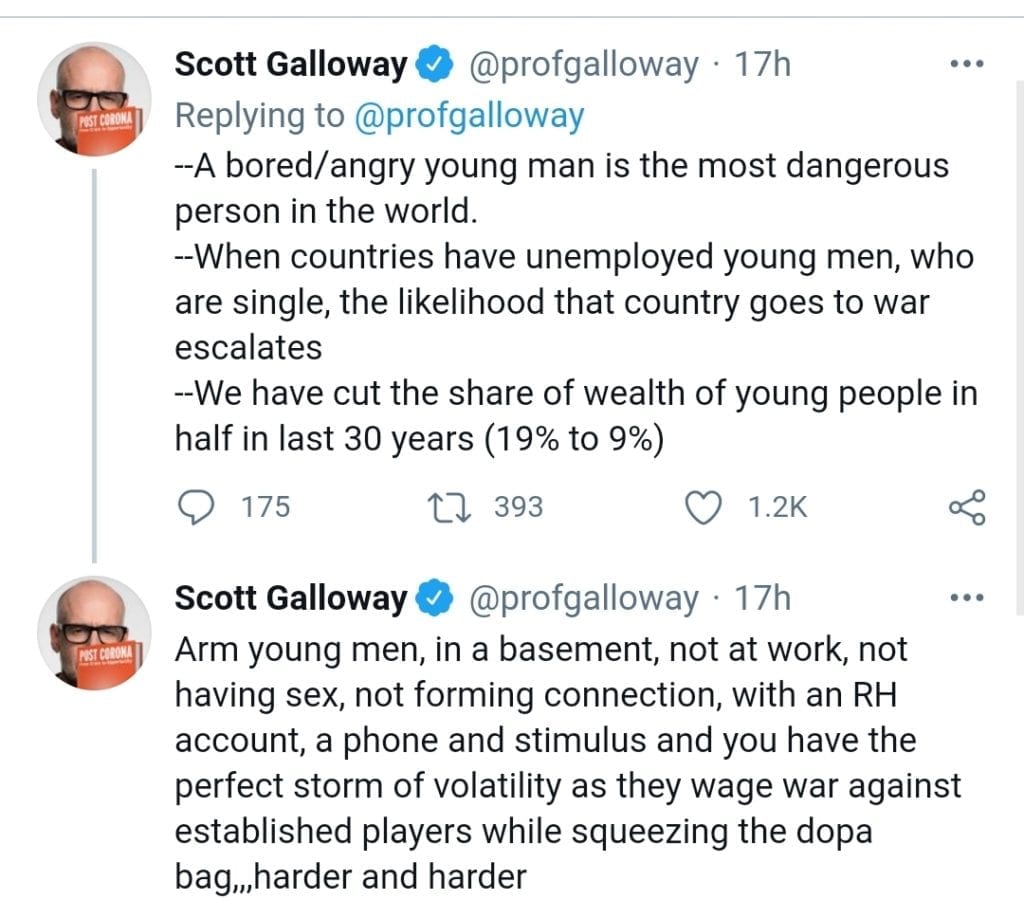

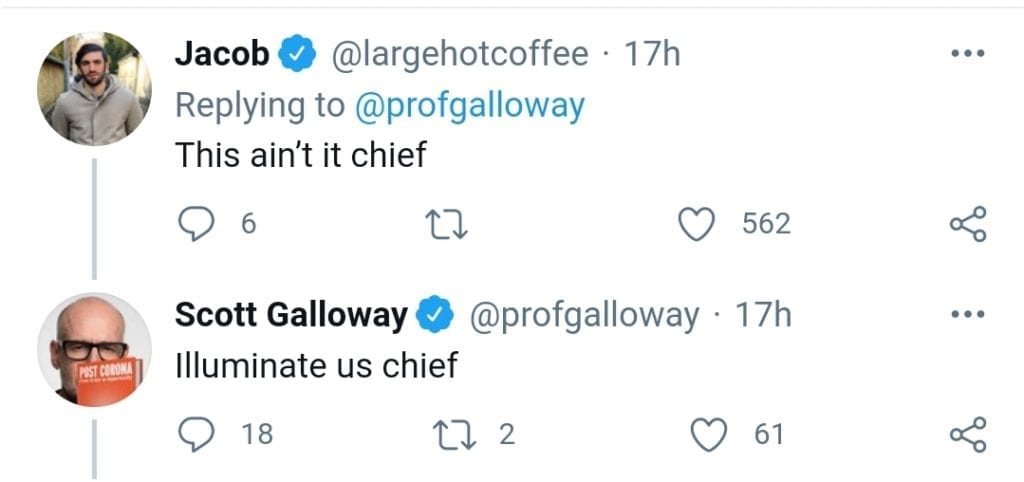

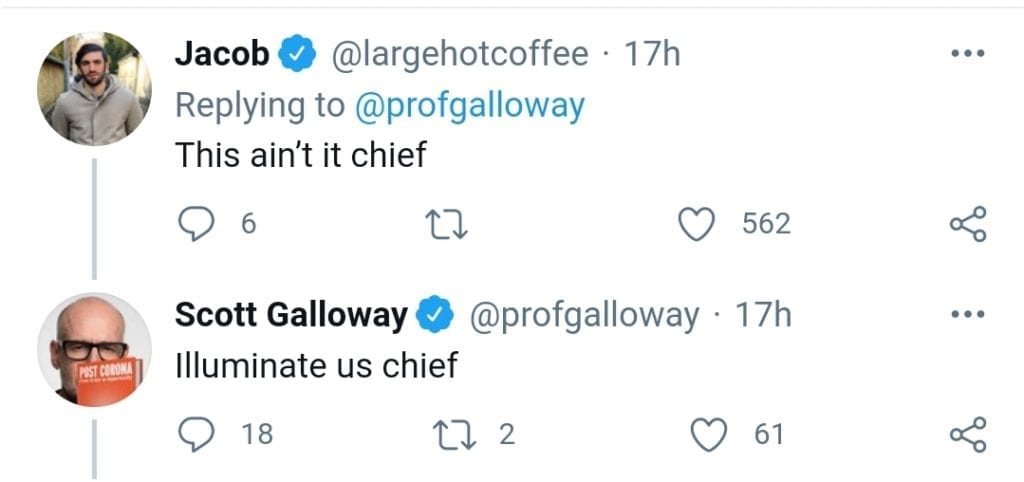

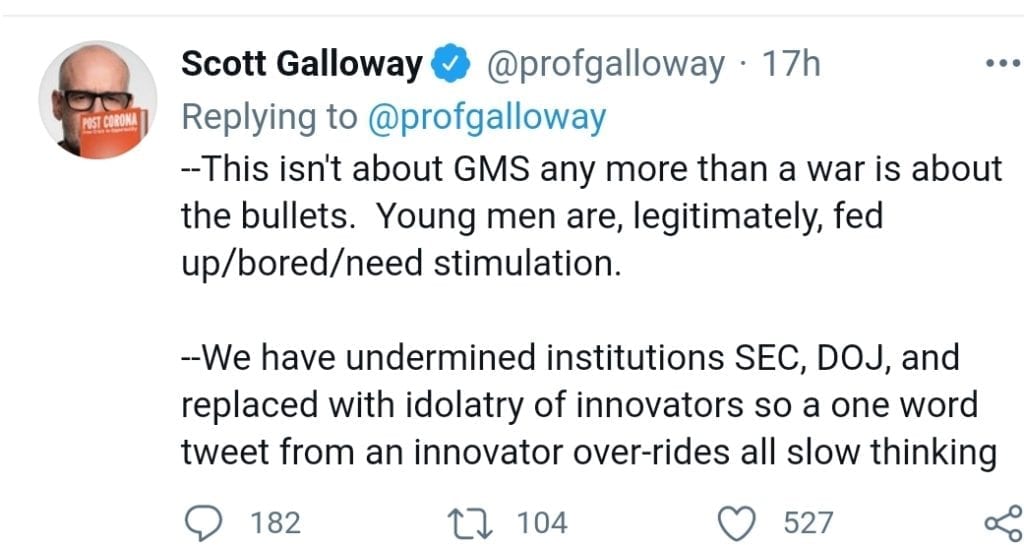

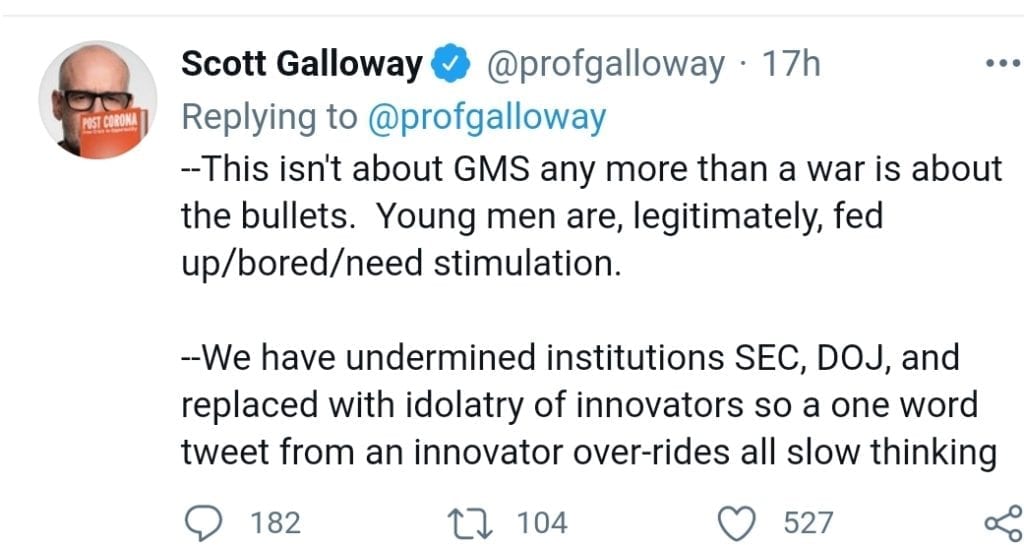

Then you have this take from supposed-professor Scott Galloway. While we’ve never heard of the guy either, he would be a GREAT fit as a faculty member here at BCU. He didn’t stop there, either.

While we’re under the belief that Scotty intended on using another word in his figure of speech, is there a more symbolic tweet that describes the modern day Blue Checkmark better than the “illuminate us chief” line? Twitter is still a free site.

Parody Accounts and sites began to join the fun as well.

Here, you see the Mets new owner with a take that aged like a fine wine.

Like a moth to a flame, the NY Times HAD to join in on the fun as well. Those darned amateur investors and their ‘greed and boredom’ taking money away from the types of people that own the NY Times.

Robinhood Escalates the Situation

As you could probably tell, Twitter was in a GREAT mood as they laughed at the billionaires losing their money in a manner akin to what they’ve done. Surely we can’t have nice things and a little bit of unity, can we?

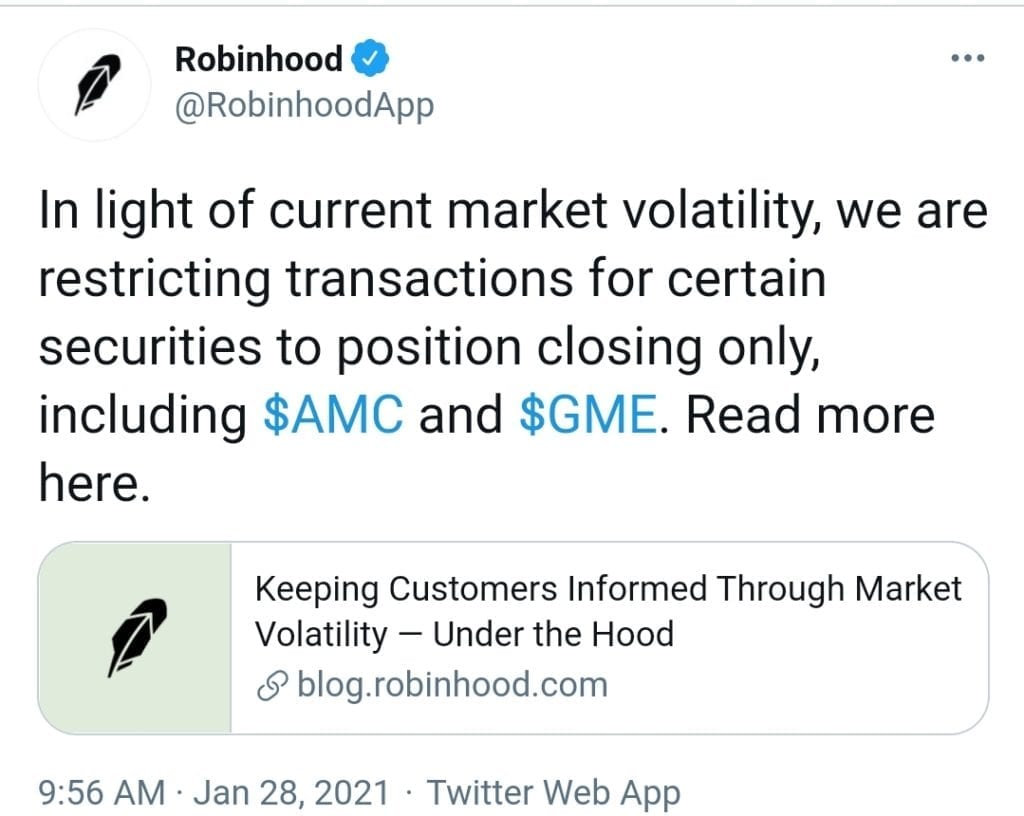

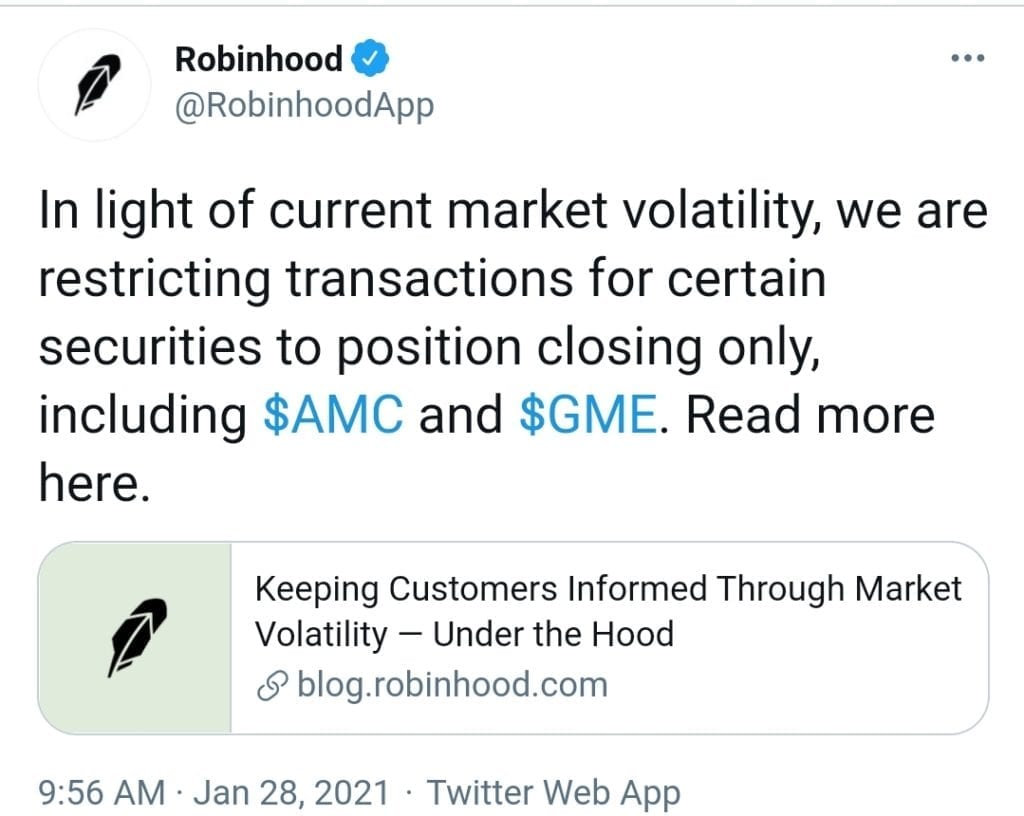

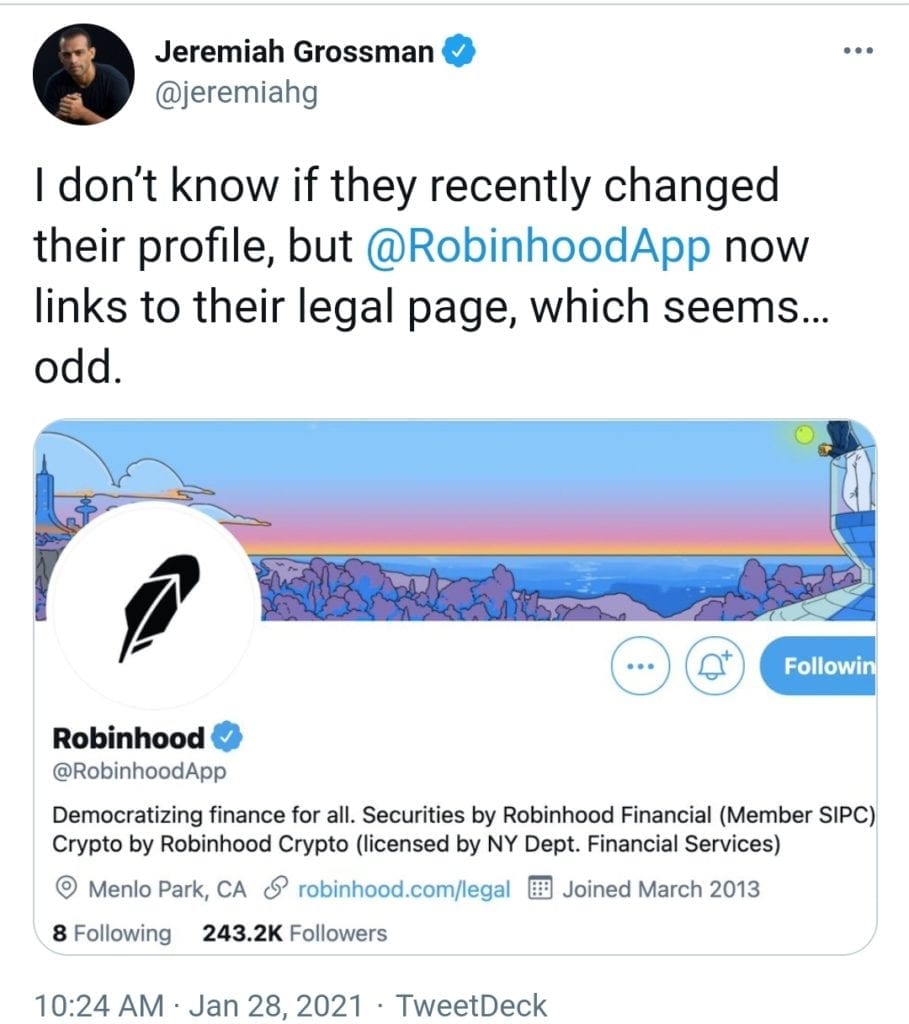

You read that correctly. Robinhood, the very app that was responsible for providing a platform for people to embarrass these billionaires, stepped-in and PREVENTED purchases of the aforementioned “meme stocks”. Surely they just want to protect the consumer, right? I mean, this is what Robinhood tweeted in 2016:

What changed in the stock market that caused Robinhood to make such a decision? Volatility exists across the board on Wall Street…..so it couldn’t be that. Douglas A Boneparth, whoever the hell that is, put it quite succinctly.

In reality, we all know what happened. Billionaires complained to Robinhood. Now the fascinating part is how openly they want to manipulate markets.

There it is. Talk about tone deaf. But alas, this is where we are in 2021.

The ‘Common Man’ Responds

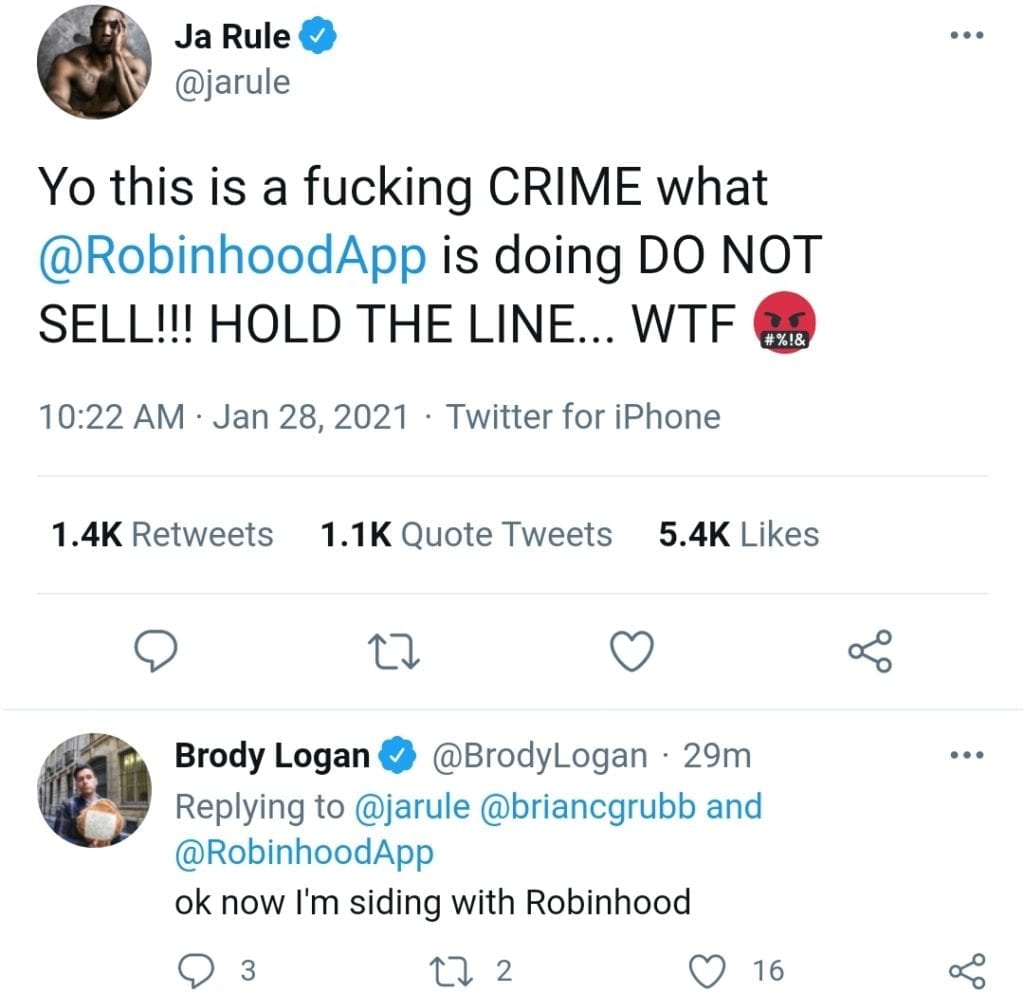

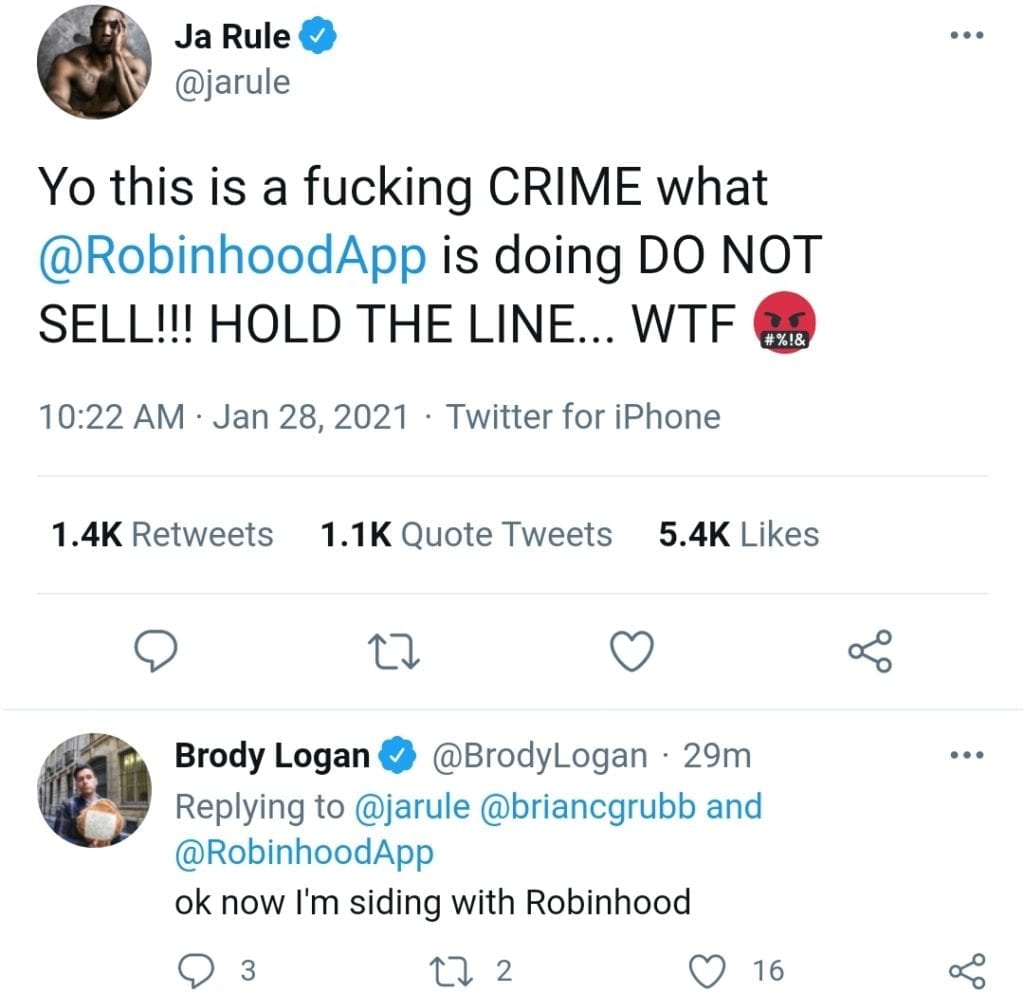

After something this egregious, you KNEW that Twitter and r/wallstreetbets were not going to stay silent.

A simple search on Twitter with the keyword ‘Robinhood’ will yield literally hours of entertainment. While we won’t post each of them in this post, we will have a link to a ‘gallery’ where each new screenshot will be added. It’s also important to keep in mind that (apparently) apps on the ‘App Store’ for iPhone users are removed upon reaching a ‘1 star’ rating collectively. This is unconfirmed, but would provide us with a STORY BOOK ending for this entire debacle. As it currently stands, Robinhood has directly intervened with the free market that they claim to protect. They said it themselves:

Where Do We Go From Here?

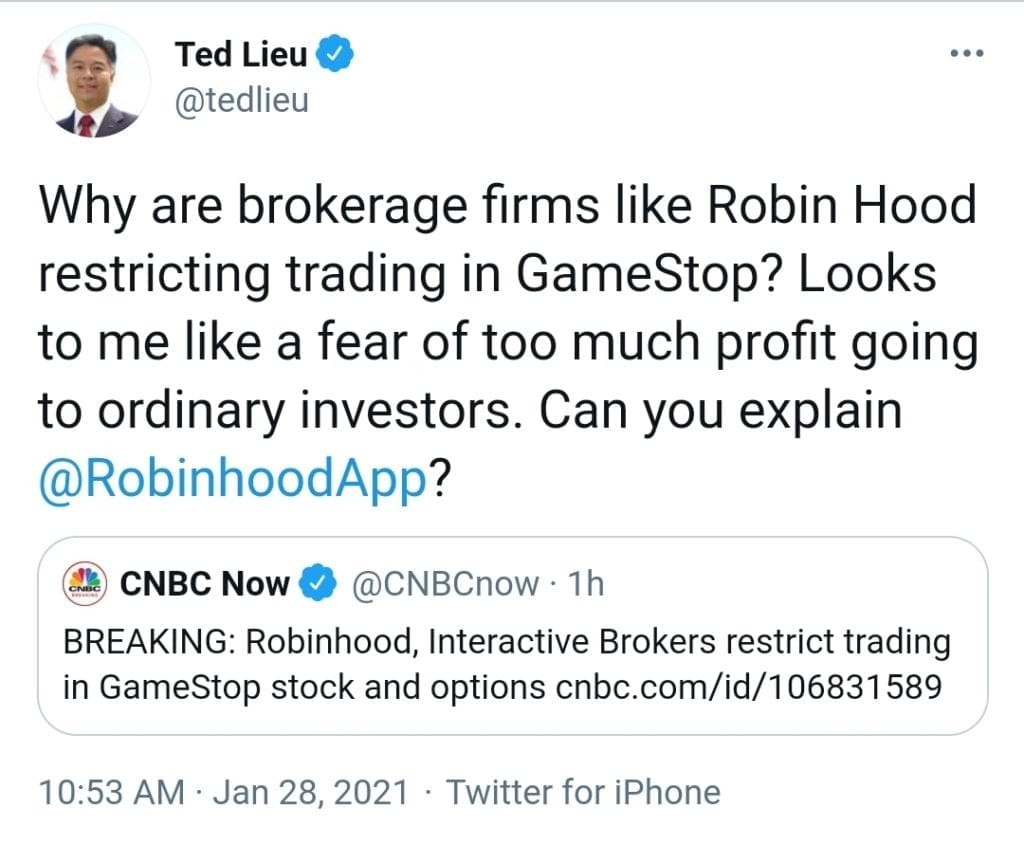

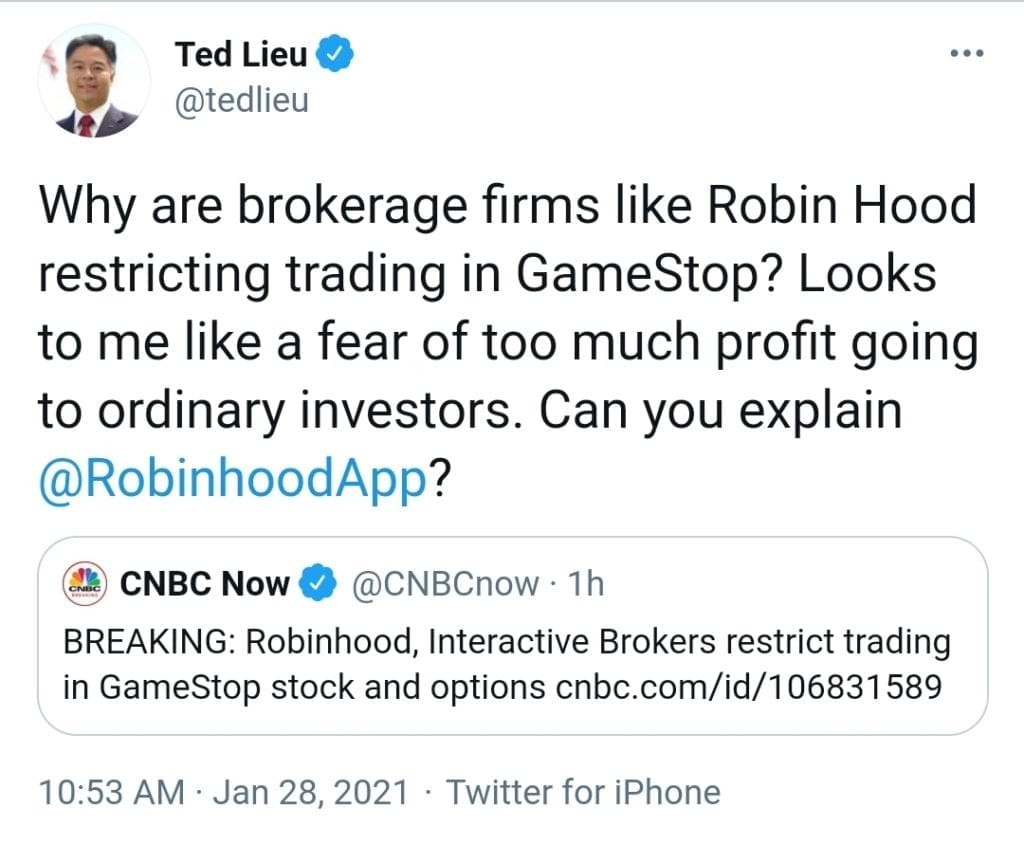

While it obviously sucks to see such a blatant power grab and market manipulation, the negative attention that Robinhood + Billionaires garnered through this all was worth more than any profits you would have made selling your shares. The days of “left vs right” political dichotomies were gone, if only for a few days. While this probably won’t change dramatically with our Blue Checkmark ‘gatekeepers’ on both sides, it offers us a glimpse of what ‘unity’ can be. Will the ever-unpopular politicians in Washington use this as an ‘olive branch’ of sorts? Probably not. But early indications from those in Congress are at least SOMEWHAT encouraging:

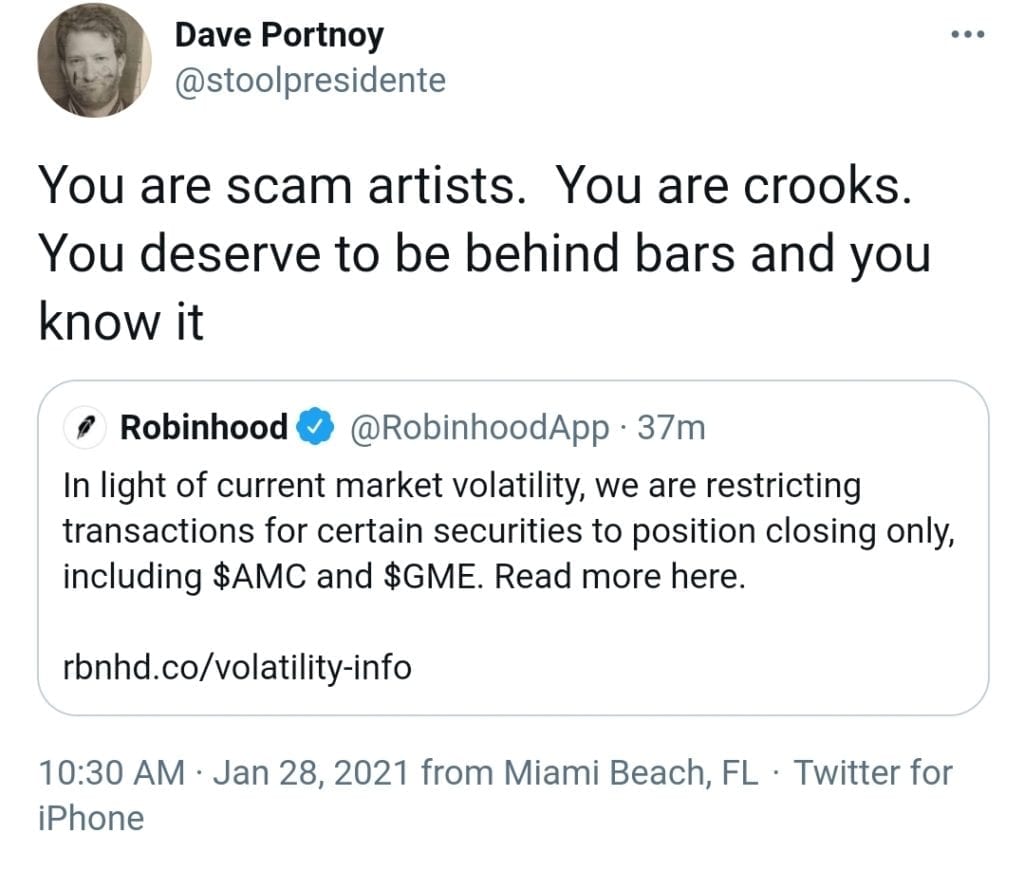

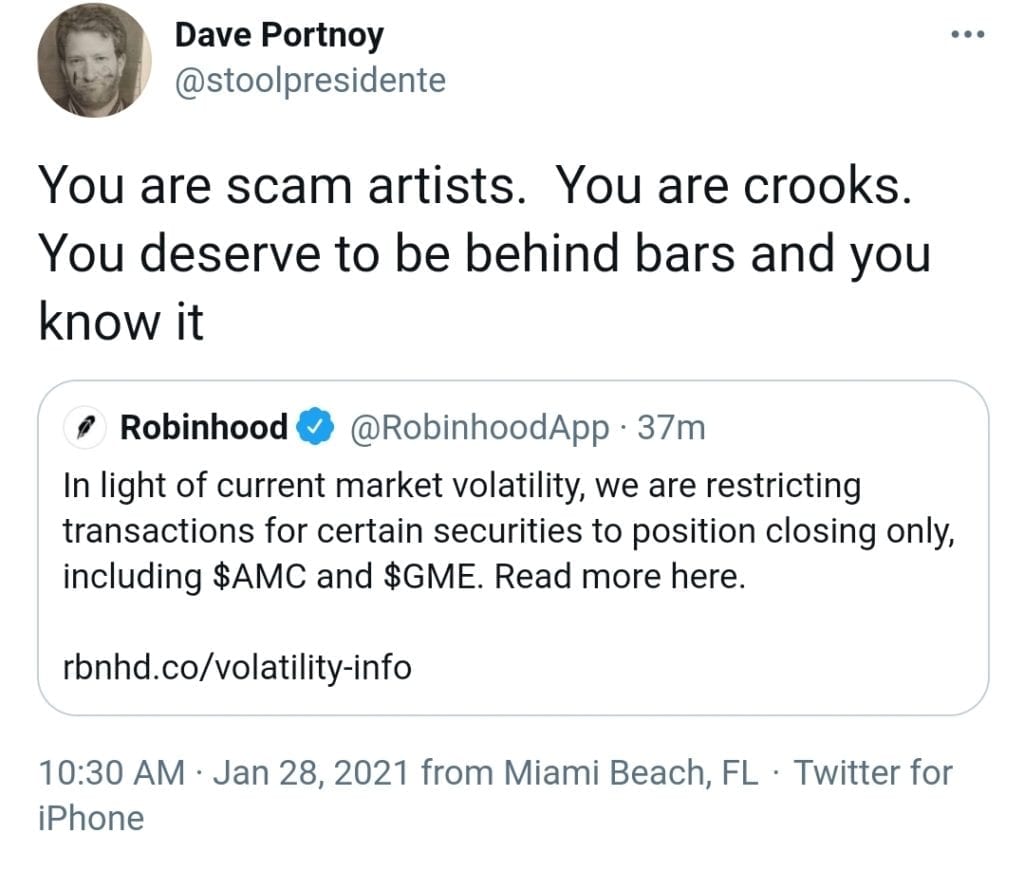

Robinhood may have unified our country more than Trump, Biden, Obama, or any other politician could reasonably achieve. The next steps will be important for sure, but moments like this have been increasingly rare across the United States. Even the ultra-lame (although we respect their Small Business fund) founders of Barstool Sports were on board:

Other unlikely heroes came to support the cause as well:

It’s hard to unify this many people behind a particular cause, but Robinhood managed to get it done. Impressive work to say the very least.

‘Robinhood School of Business Ethics’

As a result of the events from today, we at Blue Check University have decided to dedicate our school of BUSINESS ETHICS to the very company who exemplifies what the institution stands for:

Who else would be an instructor for such a program beyond Dr. Scott Galloway?

Talk about a GREAT opportunity for those lucky enough to gain acceptance into our esteemed University!

Conclusion

This was a lengthier post than what we’re accustomed to but we hope you enjoyed seeing the Billionaire rage as much as we did. An unexpected plot twist in the world of finance that has ‘2020 vibes’ written all over, we can only build from this. Thank you all for your support of our sites, Channels, pages, and accounts across the web. It truly means the world to us. For the FINAL order of business…….here’s a LINK to the aforementioned gallery of ALL Blue Checkmark Takes on the happenings of today. These are a mixed bag of good, bad, cringe, and everything in between, and will constantly be updated as we find more gold.